If there is one thing we have all learned over the last two years, it is that our circumstances can change significant and they can change fast! In the context of the pandemic, you or a family member may have experienced a redundancy, a fall or rise in business or asset values or a change in personal relationships.

While it is generally advised that you review your estate planning documents every few years, major changes in circumstances (trigger events) call for a more urgent re-evaluation of your arrangements.

I have already made estate plans, why do I need to review?

Keeping your Will, Powers of Attorney and Medical Treatment Decision Maker documents updated not only ensures that your affairs are dealt with according to your current wishes, it also relieves the burden of uncertainty on your loved ones when you pass.

Having up-to-date estate planning can also ensure that you minimise the tax that your estate or beneficiaries incur, or to avoid estate assets being gifted to a surviving spouse who may be receiving an aged pension and would prefer that assets are distributed directly to the children of the relationship.

Changes in your circumstances can happen gradually, but there are also particular events that trigger an immediate review.

While some of these events, such as marriage, will automatically change the application of your estate plan under Wills & Estates Law, other events may lead to detrimental results if appropriate action is not taken.

What particular events trigger the need for review?

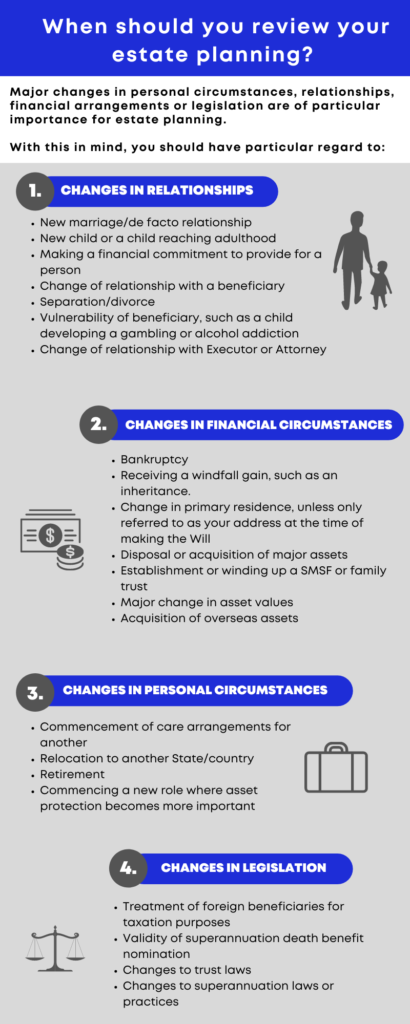

Major changes in personal circumstances, relationships, financial arrangements or legislation are of particular importance for estate planning.

With this in mind, you should have particular regard to:

Summary

In addition to considering the suitability of your estate planning arrangements every few years, particular events should trigger an immediate review, to avoid your estate plans becoming outdated. If you experience one of the events above and wish to consider how this will impact you, it is advised that you seek legal advice to ensure your estate planning documents accurately reflect your wishes.

If you require advice or have any questions in relation to the matters raised in this article, please contact our Wills, Estates & Succession Planning team.